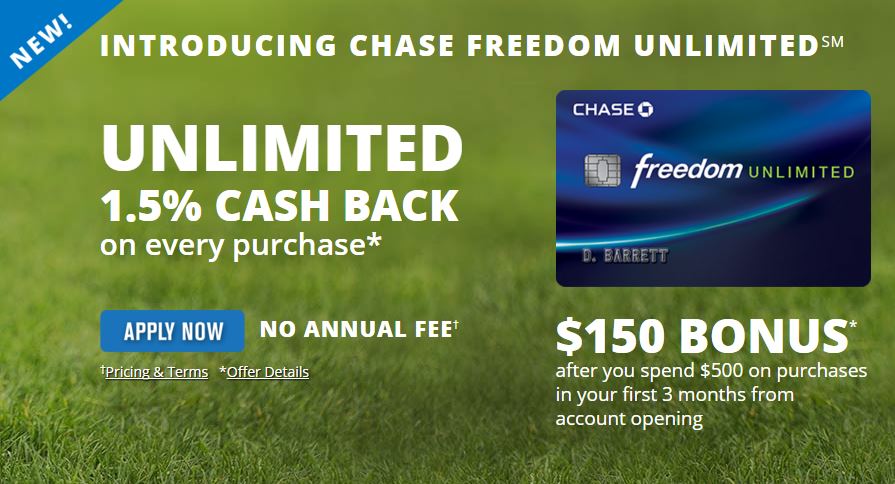

Transaction fees: Purchases that must be converted to or from U.S.Travel and emergency assistance services: Cardholders can take advantage of transportation assistance, medical and legal referral assistance, prescription assistance, emergency ticket replacement and more while traveling.Ĭhase Freedom Unlimited cardholders don’t have to pay an annual fee, but they are responsible for fees or charges on certain types of transactions, like balance transfers and cash advances.

Under the trip cancellation and trip interruption policies, you’re covered for physical sickness or injury, organized strikes, severe weather and terrorist incidents for up to $6,000.

Freedom unlimited credit card software#

Many personal items are eligible, but plants, animals, antiques, medical equipment and computer software are some notable exclusions. To submit a claim, you must provide a copy of your card receipt, a copy of the itemized store receipt, documentation if more than one payment was used and a copy of any reports relating to theft or damage (police or fire, for example). Purchase protection: Chase Freedom Unlimited Purchase Protection replaces, repairs or reimburses you for eligible items bought with the card for up to $500 per claim ($50,000 per account).Cardholders must complete the entire rental transaction using their Chase Freedom Unlimited credit card and decline the rental company’s collision damage waiver or similar provision to ensure that Auto Rental CDW is in effect. Auto rental collision damage waiver: Auto rental CDW provides secondary coverage for damage caused by theft or collision for most rental vehicles.After the 15-month 0% introductory APR period, you pay a variable interest rate based on your creditworthiness and market prime rates. Cardholders can use this time to pay off a larger purchase or pay down old debts without added interest. Low introductory APR: Both new purchases and balance transfers are eligible for the Chase Freedom Unlimited 0% APR period.

Freedom unlimited credit card plus#

Chase Freedom Unlimited cardholders enjoy benefits like balance transfers, paperless billing, contactless payment and free weekly credit scores from Credit Journey, plus additional features like travel and emergency assistance services and purchase protection for added peace of mind.

0 kommentar(er)

0 kommentar(er)